The extreme valuation and the market value of Geely Automobile are only 10 billion!

In August last year, when traditional new energy brands announced financing one after another, there was no movement until this wave of financing cooled down.

Time goes to February 2023, when the capital market is in the "cold winter", on the 13th, it announced that it had "completed the Series A financing of 750 million US dollars", with a post-investment valuation of 13 billion US dollars (about 89.2 billion yuan). The news is like a bright light illuminating the depressed automobile sector (the capital market is generally not optimistic about the forecast of the automobile market in the first half of the year, and the bleak sales in January confirmed this view. )

On the same day, Geely Automobile’s share price rose slightly by 1.03%, with a market value of about HK$ 118.1 billion (about RMB 103.4 billion). It is easy to find that the post-investment valuation of Krypton is only 14 billion yuan less than the market value of Geely Automobile. Such a situation also happened to Ai ‘an and Guangzhou Automobile Group.

However, there are only a few new energy brands with such a high valuation. Most new energy brands are valued within 30 billion yuan. One question that arises from this is, they are all new energy brands. Why are valuations so different?

Valuation can be compared with the market value of car companies.

According to the analysis of comprehensive factors such as popularity, traffic and market performance, Gaspar sorted out the valuation of more than 10 new energy brands. At present, the valuation exceeds 100 billion, only GAC Ai ‘an; Close to 100 billion, there are only extreme brands; Most brands are valued at around 30 billion yuan.

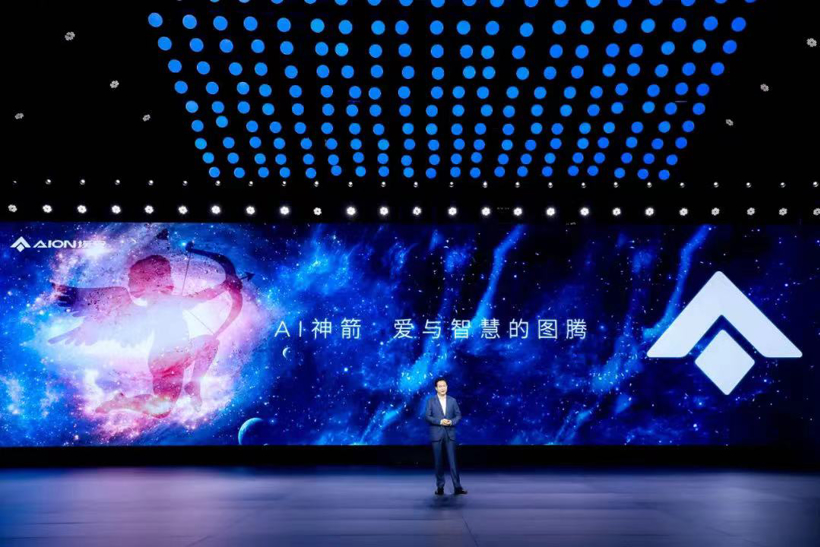

Guangzhou Automobile Ai ‘an started the A round of capital increase in July last year, and announced the introduction of 53 investors three months later, with a financing amount of 18.3 billion yuan and a post-investment valuation of 103.2 billion yuan. At this point, GAC Ai ‘an entered the third stage of mixed ownership reform, seeking opportunities to enter the capital market and establish an independent capital market platform.

In the eyes of the industry, GAC Aian introduced strategic investors, in addition to improving brand valuation, more is to prepare for listing. During the Guangzhou Auto Show last year, GAC Ai ‘an said that it would no longer raise funds before IPO. At the same time, GAC Ai ‘an revealed that it has submitted the relevant materials for the initial public offering application to the securities regulatory agency, and plans to sprint the first share of new energy vehicles in science and technology innovation board.

At the same time, Aouita, Zhiji and Lantu also started financing plans. Among them, Zhiji announced in early August last year that it had completed the first round of market-oriented financing, with a post-investment valuation of nearly 30 billion yuan, but did not disclose the specific financing amount. Aouita followed closely, saying that the post-investment valuation was close to 10 billion yuan. It was not until three months later that Lantu announced the completion of nearly 5 billion yuan A round of financing, and the post-investment valuation was almost the same as that of Zhiji.

Among many new energy brands, Aouita’s post-investment valuation is currently low. Skycar (US$ 2.94 billion, source: Changsha High-tech Zone), one of the new forces, has a slightly higher valuation than Aouita.

Image source: Weimar Automobile

Some capital analysts believe that the low valuation of some new energy brands is "lost" in the market. If a new energy brand does not have a product before financing (the first model has not been delivered at the time of Aouita A-round financing), or the market feedback after product launch is average, the valuation will be greatly discounted.

A typical case is Weimar. Before the financing of traditional new energy brands, Weimar replaced the listed "Wei Xiaoli" and became the new force with the highest valuation after the investment. At its peak, Weimar once set a single highest financing in the history of new power-10 billion yuan, and its post-investment valuation once reached 50 billion yuan. However, due to poor market performance, Weimar’s current valuation has shrunk to 17 billion yuan.

There are also new forces to "turn over". After Aichi Automobile was acquired by Huaxia Boya in November 2022, its valuation became $5 billion to $6 billion. This should be related to the fact that Aichi Automobile was "taken over" by the new shareholders, and its operation was once again on the right track, and there was a "new story" to tell (the second new car Aichi U6 went on the market, while continuing to explore overseas markets such as Europe and Israel).

Judging from the current valuation, traditional new energy brands are generally better. However, if Xiaomi Automobile raises external financing, it may break the record of 100 billion valuation maintained by Ai ‘an. Earlier, it was reported that the pre-investment valuation of Xiaomi Automobile in the capital market was HK$ 500 billion. According to informed sources, Xiaomi Automobile is also seeking external investment.

Baidu, another cross-border Internet company that makes cars, does not seem to be too "amazing" in the valuation of its Jidu cars. In August last year, news came out that Jiji was considering raising about 300 million to 400 million US dollars, with a target valuation of about 3.5 billion US dollars.Even so, the target valuation of Jidu is higher than the market value of some listed car companies.

Image source: Guangzhou Automobile Aian

At present, the brand valuation of new energy vehicles is on the high side, higher than the market value of listed car companies, which seems to have been regarded as the normal state. The market value of many listed car companies is between 10 billion and 30 billion, such as Beiqi Blue Valley (27.3 billion yuan) and jiangling motors (13.1 billion yuan), which is far lower than the valuation of some new energy brands. Not to mention, the valuations of the two major brands, Guangzhou Automobile Ai ‘an and Extreme Krypton, are even comparable to or close to the independent market value of Geely (HK$ 114.2 billion), Guangzhou Automobile Group (RMB 119.2 billion) and Changan (RMB 131.2 billion).

The capital market is willing to pay for new energy brands, which is a "bet on the future".The intelligent label of new energy brand makes it have a strong attribute of science and technology enterprise and is a symbol of "potential stock". For new energy brands with strong background support and market performance, the capital market will not be stingy to raise the valuation.

In this way, the valuation of new energy brands is generally higher than that of traditional car companies, and the valuation of new energy brands is high or low.

High valuation, you have to speak with market performance.

"Valuations are all negotiated," said a person familiar with the matter. But what is certain is that,The capital market has its own system to evaluate the potential of an enterprise. andCompared with the "Wei Xiaoli" period, now "PPT making a car" has not fooled investors.

At present, there are more than 100 new energy automobile enterprises in China, but the brands that have been financed in the past two years have basically achieved mass production delivery. Five or six years ago, when the traditional new energy brands were not added, many new forces could get financing only by "PPT building cars", such as the bankrupt Ranger, Singularity, Baiteng and Sailin.

After several rounds of bankruptcy tide of new forces, investors’ cognition of "building a car" has become profound. On the other hand, there are more and more brands of new energy vehicles, and there are many financing and IPO plans. The number of investment targets in the primary market has increased, and the investment threshold has been continuously raised. To a certain extent, achieving mass production delivery has become one of the basic conditions for financing and a major factor in improving valuation.

Is Xiaomi car an exception?

The first model of Xiaomi Automobile is scheduled to be delivered in mass production in 2024, but it does not affect the optimistic capital market. That’s because, in the view of the capital market, Xiaomi has mastered the "flow password" of making cars.

As we all know, the arrival of the era of smart cars has changed the "gameplay" of the automobile market. China electric vehicle committee of 100 report pointed out that cars are changing from travel tools to the next generation of intelligent terminals. Cars have the attribute of "consumer electronics", and the concept of "buying new things instead of buying old ones" is quietly prevailing.

Xiaomi’s next car is more like expanding the existing smart home ecological chain in a closed loop. At present, Xiaomi has built a strong smart home ecological chain around mobile phones, televisions and routers, and has opened more than 10,000 offline stores in prosperous areas. The consumption concept of "buying millet" and "visiting millet" has occupied the minds of many young consumers.

Some people believe that this part of consumers can be converted into the original users of Xiaomi Automobile, and existing stores can speed up the laying of sales channels of Xiaomi Automobile.

Image source: Xiaomi

Major shareholders, high flow, storytelling and great market potential are the reasons for Xiaomi Automobile’s high valuation. These factors are also an important reference for the capital market to evaluate new energy vehicle brands.

"Large shareholder+high flow" means that the brand market is guaranteed to some extent. Traditional new energy brands are either from state-owned enterprises or escorted by large groups like Krypton. The "investment army" behind the hot new forces is not to be underestimated, not only investment predators, financial institutions, cross-border groups, etc., but also some local SASAC blessing. Comparatively speaking, because the new forces are more closely tied to the capital market, valuation sometimes benefits more.

But,The key factor that determines the valuation of new energy vehicles is stillMarket performance.

The valuation of the two major brands, Ai ‘an and Extreme Krypton, is much higher than that of other new energy brands. The key lies in the strong market performance-high sales trend and sufficient development potential. In 2022, the sales volume of Guangzhou Automobile Ai ‘an reached 270,000 vehicles, and it maintained a double-speed growth trend. In the same year, Krypton sold 70,000 new cars in the mid-to high-end market of around 300,000. On the other hand, Aouita, Zhiji and other brands, due to slow climbing after mass production delivery, their market performance needs to be improved.

In terms of new forces, Weimar’s sales continued to fall behind, and its survival and operation were trapped, resulting in a sharp decline in financing scale and valuation. Although the sales volume of Hezhong Automobile is higher, it is considered that the profit margin of bicycles is thin (the price of main models is about 100,000), and the valuation is not better for the time being. Gaohe, which mainly focuses on the 500,000+market, has a low popularity due to its average market performance (annual sales of thousands of vehicles), and its valuation is hovering around 30 billion yuan.

Image source: Extreme brand

Of course, the valuation is not static, but dynamic. If the fundamentals of a new energy brand improve significantly (market share increases and profitability improves), the post-investment valuation will definitely change, and vice versa.

Just like Xiaomi Automobile, after the price of the first product came out, the market’s comments changed a little. It is reported that the pricing of the first product of Xiaomi Automobile is close to 300,000 yuan, exceeding the industry expectation. There was a view that the pricing of Xiaomi automobile products should be less than 200,000 yuan, which is more in line with Xiaomi’s cost-effective label and fits the target audience. However, the market is the touchstone for testing Xiaomi automobile, and it is also the fundamental basis for the capital market to evaluate it.

Pursuing the maximization of valuation is the goal of all new energy automobile brands. However, the conditions reached are also extremely "harsh", and factors such as flow, heat, profit, good stories, funds and sales are generally indispensable. In the cold winter of capital, new energy brands that can also impress investors need to have "hard power". Extreme krypton is a representative of success; Weimar, however, became uncertain.